A Case Study on IP-Backed Finance: Lessons from South Korea

A few years ago, if someone had told me you could walk into a bank, lay a patent on the table, and walk out with a loan, I would have laughed. Yet, in South Korea, this isn’t just an idea—it’s reality. They’ve built a system that treats intellectual property (IP) as the financial asset it deserves to be. And for anyone who’s spent sleepless nights wondering how to fund the next breakthrough, it’s nothing short of inspiring.

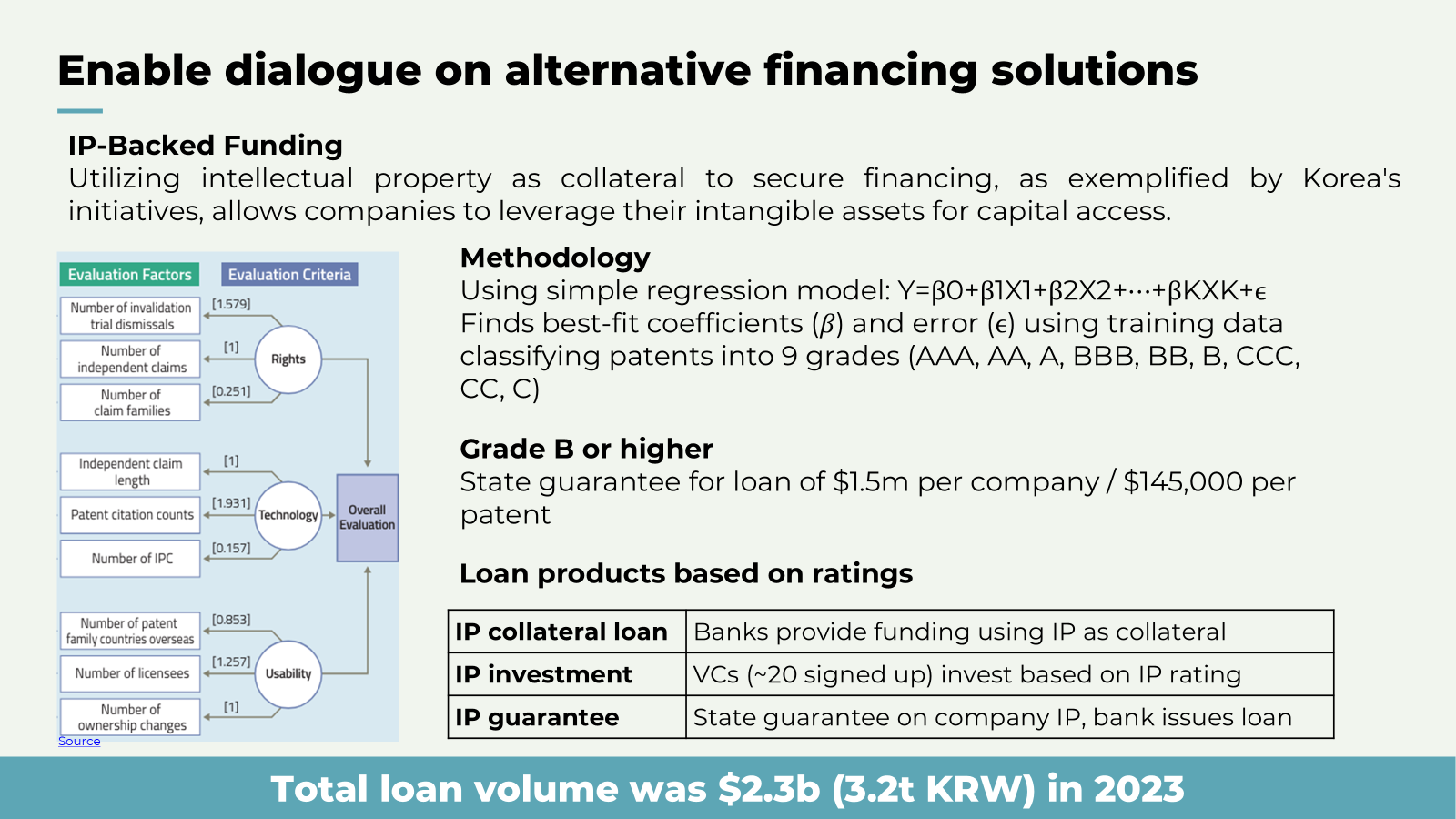

South Korea’s IP-backed finance system is a marvel of modern financial engineering. It’s precise, methodical, and—most importantly—effective. But what really sets it apart is how it brings together government policy, valuation science, and private-sector execution to create a robust ecosystem. Let me walk you through how they’ve done it.

The Foundations: Building Trust in Intangibles

South Korea’s journey into IP-backed finance didn’t happen overnight. The first hurdle was perhaps the hardest: convincing banks and financial institutions that IP is more than just an idea on paper—it’s a tangible asset with real, calculable value.

This was where the government stepped in. The Korean Intellectual Property Office (KIPO), in collaboration with the Financial Services Commission (FSC), laid the groundwork for a system that could assess, standardize, and monetize IP assets. The approach wasn’t about throwing money at the problem—it was about building trust.

You can learn more about KIPO’s IP-backed finance initiatives here.

Step 1: Valuation—The Heart of the System

The cornerstone of South Korea’s IP-backed finance system is valuation. After all, no lender is going to give you a loan unless they know exactly what your IP is worth.

How Does Valuation Work?

- Expert Networks:

- Korea created specialized institutions, like the Korea Invention Promotion Association (KIPA), to handle IP valuations. These are not general appraisers but dedicated experts trained to assess the commercial and legal strength of IP portfolios.

- SMART Valuation Models:

- Korea developed proprietary tools like SMART5, which evaluate IP based on factors such as market potential, legal enforceability, and technological uniqueness.

- Standardization:

- KIPO implemented standardized valuation protocols to ensure consistency and reliability, giving lenders confidence in the system.

Step 2: Financial Products—Tailored for Innovation

With valuation tools in place, the next step was designing financial products that could leverage IP as collateral. Here’s where South Korea’s creativity shines.

IP-Backed Loans

The most common product is the IP-backed loan, where businesses use their patents or trademarks as collateral. A startup submits its IP portfolio for valuation, and if it meets the lender’s criteria, it receives a loan based on the IP’s assessed value—no need for physical assets like real estate or equipment.

IP Sale-and-Leaseback

For companies that need liquidity but wish to retain control of their IP, Korea has introduced sale-and-leaseback models:

- Companies sell their IP to financial institutions for immediate cash and then lease it back to continue using it.

Step 3: Government Guarantees—Mitigating Risk

Lenders are naturally cautious, especially when dealing with something as abstract as IP. To address this, the Korean government introduced a backstop: guarantees.

The Role of KOTEC

The Korea Technology Finance Corporation (KOTEC) acts as a guarantor for IP-backed loans. If a borrower defaults, KOTEC absorbs a significant portion of the lender’s loss, reducing risk and encouraging banks to participate in the system. Learn more about KOTEC here: .

In 2020, KOTEC-backed loans exceeded KRW 708.9 billion (approximately $590 million), with low default rates.

Step 4: Education and Awareness—Creating a Market

Even the best financial products won’t work if people don’t know they exist. South Korea invested heavily in educating businesses and financial institutions about the potential of IP-backed finance.

- KIPO regularly hosts workshops and seminars to train entrepreneurs on building strong IP portfolios and understanding the valuation process.

- Specialized lender training is also conducted to ensure financial institutions understand the nuances of IP-backed loans.

The Impact: Numbers That Speak Volumes

South Korea’s IP-backed finance system has achieved extraordinary results:

- Over $3 billion in loans disbursed since its inception.

- Repayment rates exceeding 97%, highlighting the reliability of IP-backed loans.

- A thriving innovation ecosystem where IP-intensive industries, such as biotech, green tech, and electronics, are flourishing.

Lessons from South Korea

What makes South Korea’s system so effective is its precision. Every piece of the puzzle—valuation, guarantees, education, and product design—works in harmony. It’s a system that doesn’t just dole out money; it creates confidence. And that confidence drives innovation.

For me, this case study is more than a success story. It’s a roadmap for how we can rethink financing for a world where ideas are the most valuable asset of all. South Korea isn’t just unlocking the potential of IP—it’s proving that with the right tools and mindset, you can turn intangible assets into tangible growth.

Member discussion