Europe’s Competitiveness Compass: Will Pension Funds Finally Back Innovation?

Brussels has a new plan. The Competitiveness Compass, the European Commission’s latest attempt to reinvigorate the EU economy, comes with a familiar diagnosis: Europe has world-class talent but lacks the capital to scale its own innovations. The remedy? A bold—if somewhat overdue—proposal to mobilize pension funds and household savings to finance European innovation.

On paper, this makes perfect sense. The EU’s household savings rate was 65% larger than that of the US in 2022, meaning there is no shortage of capital. The problem is that Europeans seem remarkably unwilling to invest in themselves. Instead of funding local start-ups or backing transformative sectors like AI, biotech, and quantum computing, €300 billion of European savings leave the continent each year, financing growth elsewhere—mostly in the US and China.

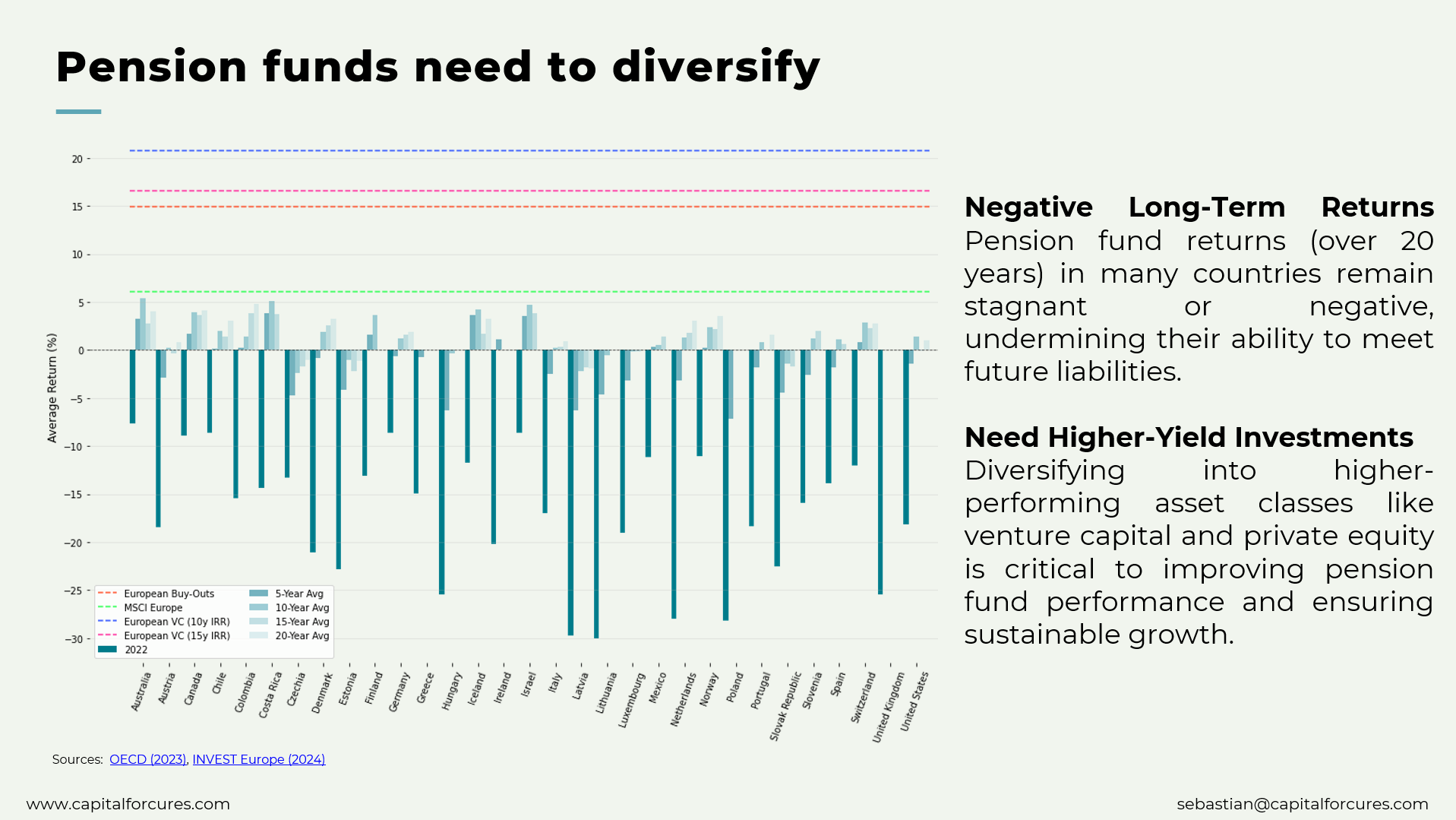

European pension funds are part of the problem. Compared to their North American counterparts, they have been exceptionally conservative, favoring government bonds and low-yield equities over higher-risk, higher-reward asset classes like venture capital and private equity. The result? Two decades of lackluster returns, putting pressure on pension systems already struggling with aging populations and growing liabilities.

The Competitiveness Compass now aims to change this, promising to remove barriers to private capital mobilization and promote equity investment over traditional bank lending. But will pension funds really shift gears?

Capital for Cures: Moving Faster Than the Policy Makers

While the European Commission drafts its proposals, Capital for Cures is already doing what Brussels keeps saying must be done: actively mobilizing pension fund capital and other private investment into sectors where Europe has both scientific excellence and commercial potential—most notably biotech and life sciences.

Why biotech? Because unlike trendy but fleeting investment themes, biotech is a sector where patient capital is not just beneficial—it’s essential. Developing new therapeutics, AI-driven diagnostics, and breakthrough treatments takes time, expertise, and funding models that can tolerate long development cycles. Pension funds—if structured correctly—are an ideal match.

What Capital for Cures is doing differently:

- Pension funds often see venture capital as too risky, too opaque, and too illiquid—barriers that have historically kept institutional capital on the sidelines of high-growth industries like biotech. At Capital for Cures, we are bringing together pension funds, funders, regulators, and the biotech industry to investments into venture capital.

- Matching capital with impact: Investing in neurotechnology, life sciences, and advanced healthcare isn’t just about chasing high returns—it’s about funding innovations that will extend life expectancy, improve healthcare systems, and drive economic growth.

- Bridging the funding gap: The EU has a chronic shortage of late-stage capital. Too many promising biotech firms either sell too early, relocate abroad, or fail to scale. We are working to connect European pension funds with high-growth opportunities, ensuring that Europe’s best ideas stay in Europe.

Join Us in Amsterdam on March 5th

If you’re interested in how pension funds and private capital can drive biotech innovation, we’d love to continue this conversation at the next Capital for Cures event in Amsterdam on March 5th.

Our guiding principle remains clear: doing good and doing well are not mutually exclusive. We’re excited to welcome Jayasree Iyer, CEO of the Access to Medicine Foundation, as one of our key speakers. Capital for Cures is also gaining additional traction and has recently been featured by HollandBio, the Dutch Biotech Association, as well as HealthHolland, the main health investment promotion agency.

You can find the full agenda and registration page here: https://capitalforcures.rsvpify.com/.

A Compass Is Useless If You Never Start Walking

The Competitiveness Compass is directionally correct—Europe needs deeper capital markets, needs to channel more private savings into productive investment, and needs pension funds to stop playing it so safe that they barely keep up with inflation. But a strategy document is not the same as execution.

Europe has had no shortage of grand economic roadmaps, from Lisbon 2000 (which promised to make the EU the most dynamic knowledge-based economy in the world) to Europe 2020, which envisioned a thriving “Innovation Union.” Neither quite worked out.

If Brussels is serious this time, it must do more than nudge pension funds—it must create real incentives for them to deploy capital into innovation, just as Canada, the US, and even Australia have already done.

Meanwhile, at Capital for Cures, we are not waiting for another decade of policy debates. We are already building the bridges between institutional capital and European innovation—because Europe doesn’t just need a compass.

It needs momentum.

Member discussion