Welcome to Medicocristan: Why Mediocrity Is the Enemy of Breakthroughs

Medicocristan is a place where mediocrity reigns supreme. Its streets are orderly, its people are risk-averse, and its leaders champion safety over boldness. It’s a world where the "tried and true" always beats the "unproven and risky," and where every decision must pass the scrutiny of a committee. At first glance, Medicocristan might look like a sensible utopia—stable, predictable, and conflict-free. But scratch the surface, and its flaws become glaringly apparent. This is a world where average outcomes dominate at the expense of exceptional results.

In industries like venture capital, biotech, and fundraising, Medicocristan thinking isn’t just a nuisance—it’s a fatal flaw. The obsessive focus on conformity and incremental gains smothers the very traits that drive transformative success: bold bets, radical ideas, and belief in the power of outliers.

The Tyranny of the Average: Why Mediocrity Persists

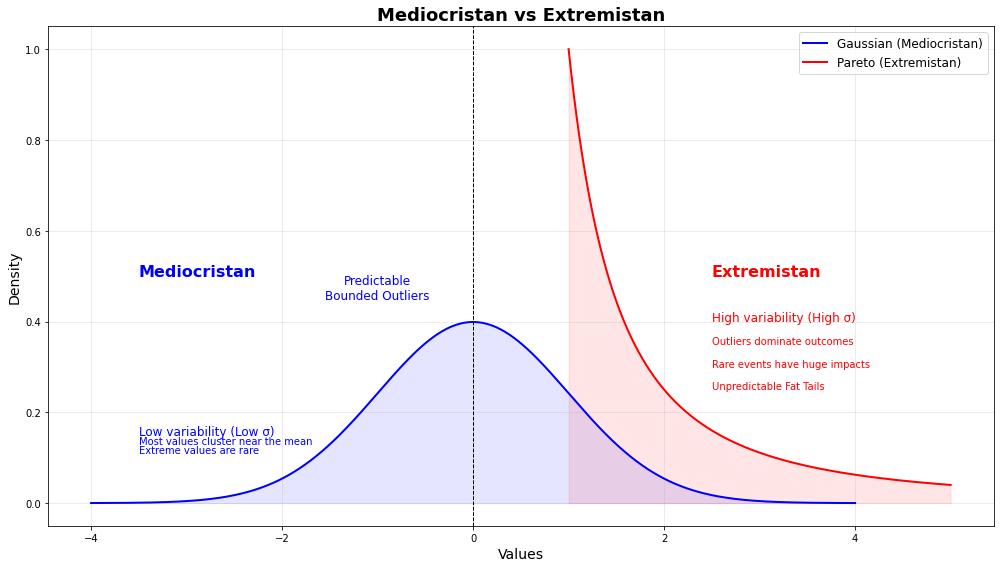

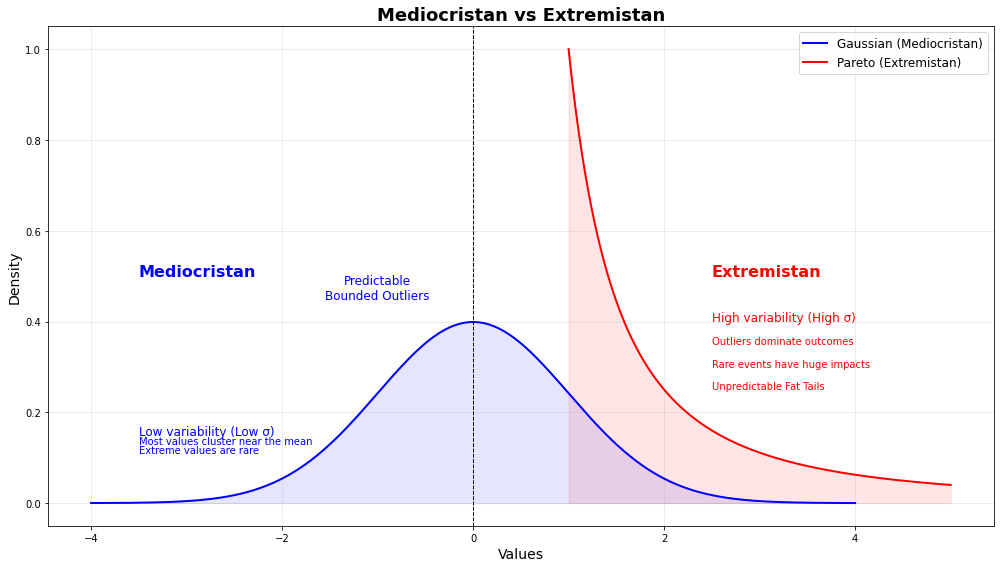

The real problem with Medicocristan is its reliance on averages. It views the world through the lens of what’s “typical” or “safe,” celebrating norms and penalizing deviations. In statistics, this mindset is rooted in the Central Limit Theorem, which suggests that as sample sizes grow, distributions cluster around a mean. The bell curve—a comforting, symmetrical shape—becomes the default model for understanding everything from talent to risk.

But not all systems follow a bell curve. Many industries, particularly venture capital and biotech, operate in what Nassim Nicholas Taleb calls “extremistan,” where outcomes are governed by power laws. In these systems, a few outliers dominate, while the majority of results are negligible. Most VC portfolios, for example, see 90% of investments fail, but the remaining 10% deliver outsized returns that make the losses irrelevant.

Medicocristan thinking is fundamentally unsuited to such environments. It prizes safe bets and incremental improvements, blind to the fact that transformative success lies far beyond the average.

The VC Dilemma: Betting on Outliers

If you want to see Medicocristan at its worst, look no further than traditional investment strategies. Venture capital, for example, thrives on the opposite of mediocrity. It’s not about avoiding failure—it’s about embracing it, knowing that one big win can make up for a dozen losses.

Consider the early days of companies like Facebook or Uber. At the time, these ideas seemed ludicrous to many investors. Facebook was entering a crowded social media landscape dominated by MySpace. Uber was facing legal battles and regulatory uncertainty. Yet contrarian investors like Peter Thiel and Bill Gurley recognized their potential, betting on the possibility of exponential returns.

In Medicocristan, such bets would have been vetoed as “too risky” or “not scalable.” Imagine a VC firm run by Medicocristan principles: every pitch would require a five-year earnings projection, a tidy revenue stream, and a “reasonable” growth trajectory. That’s the kind of thinking that produces endless apps for meal delivery but misses the next game-changing platform.

The Biotech Trap: Why Mediocrity Fails in Healthcare

Biotech and pharma are no less immune to Medicocristan thinking. The industry’s reliance on averages—average patient responses, average efficacy rates, average revenue projections—has stifled innovation for decades. Clinical trials are designed to target the “average patient,” ignoring the fact that most drugs follow fat-tailed distributions where a small subset of patients (the so-called super-responders) see outsized benefits.

Take the example of Iressa (gefitinib), an early lung cancer drug. Initial trials showed mediocre results when measured against average outcomes, and the drug was nearly abandoned. However, further research revealed that Iressa worked exceptionally well for a specific genetic subgroup of patients. If Medicocristan had its way, the drug would never have reached those who needed it most.

This obsession with averages also explains why rare diseases are so often ignored. Medicocristan pharma companies view them as “too small” to justify investment. Yet the rare disease market, driven by orphan drugs with premium pricing, has become one of the most lucrative areas of medicine.

Mediocrity in Fundraising: How It Stifles Innovation

Medicocristan thinking infects not just industries but also the way they’re funded. In fundraising, whether for startups or nonprofits, the Medicocristan approach prioritizes polished pitch decks, safe narratives, and predictable outcomes. Funders are drawn to ideas that fit neatly into existing frameworks, not ones that challenge them.

This is a particular problem in biotech. Early-stage drug discovery often requires massive upfront investment with no guarantee of success. Investors who demand immediate ROI (return on investment) or shy away from ambiguous risks often miss out on the next Moderna. Consider how venture capitalists treated mRNA technology before COVID-19: most dismissed it as too speculative. It took a pandemic to validate the science and deliver the outsized returns that now seem inevitable in hindsight.

What a Medicocristan Company Looks Like

Let’s imagine a company fully committed to Medicocristan principles.

- Leadership: The CEO is a former management consultant who excels at streamlining processes but avoids risk at all costs. Innovation teams are encouraged to think “outside the box,” but only within the confines of quarterly KPIs.

- Product Development: New projects are limited to small, incremental improvements on existing products. Radical ideas are shelved because they don’t meet the “hurdle rate.”

- Recruitment: The company hires candidates who “fit the culture,” ensuring a homogenous workforce that avoids conflict and dissent. Diversity of thought is seen as a potential liability.

- Strategy: Long-term planning revolves around benchmarking competitors and following industry trends, ensuring that the company is always a step behind the market leaders.

Breaking Out of Medicocristan: Lessons for the Bold

1. Embrace Failure

In venture capital and biotech, failure isn’t a bug—it’s a feature. Firms like Andreessen Horowitz and Sequoia Capital don’t just tolerate failure; they plan for it. This mindset allows them to take big swings, knowing that a single home run can make up for dozens of strikeouts.

2. Focus on Outliers

Taleb’s concept of antifragility emphasizes the importance of systems that benefit from volatility. In biotech, this means designing trials that identify and capitalize on super-responders rather than averaging them out. In VC, it means betting on ideas with massive upside, even if they come with high risks.

3. Build for Diversity

Cognitive diversity is a powerful antidote to Medicocristan thinking. Hiring neurodivergent individuals, contrarians, and those with unconventional backgrounds introduces fresh perspectives that challenge groupthink.

4. Look Beyond Metrics

Metrics like average efficacy or quarterly earnings are tools, not gospel. The real value often lies in the tails of distributions—in the outliers that don’t fit the model.

Final Thoughts: Leaving Medicocristan Behind

The allure of Medicocristan is hard to resist. Its systems feel safe, its rules predictable, its rewards stable. But in a world defined by exponential progress and extreme uncertainty, Medicocristan’s virtues become its vices.

True success—whether in venture capital, biotech, or life itself—doesn’t come from avoiding failure or clinging to the average. It comes from embracing the messy, unpredictable reality of extremistan. It comes from betting on outliers, challenging norms, and daring to think differently.

The future belongs to those who leave Medicocristan behind. The question is: will you?

Member discussion