Why I Started Capital for Cures: Turning Frustration Into Action

A few months ago, I hit a wall—hard. I’d spent years working with biopharma companies, startups, and investors, trying to help them navigate the labyrinth of European funding and regulation. But over time, I realized something unsettling: being good wasn’t enough.

No matter how many introductions I facilitated or how many strategies we mapped out, the underlying problem never changed. There simply wasn’t enough capital in Europe to support the kind of bold, transformative healthcare innovation we so desperately need. Time and again, I saw promising companies stall for lack of funding. Brilliant founders were giving up, not because their ideas were flawed, but because the system was.

The Frustration That Sparked Capital for Cures

It wasn’t just the startups that were stuck—I was stuck. I grew increasingly frustrated watching the same cycle repeat itself:

- A European startup develops a promising therapy.

- They scrape together just enough funding to get to Phase 1 trials.

- Then the money runs out, and they either stall or sell to a U.S. buyer at a bargain price.

Meanwhile, across the Atlantic, those same companies would likely have been showered with venture capital and taken public in IPOs that trade at a premium. In Europe, however, IPOs trade at steep discounts—if they happen at all.

I kept asking myself: Why is this so hard? Why is it that a continent with world-class science, top-tier talent, and massive wealth can’t seem to fund its own healthcare future? The answer became painfully clear: Europe has a capital problem.

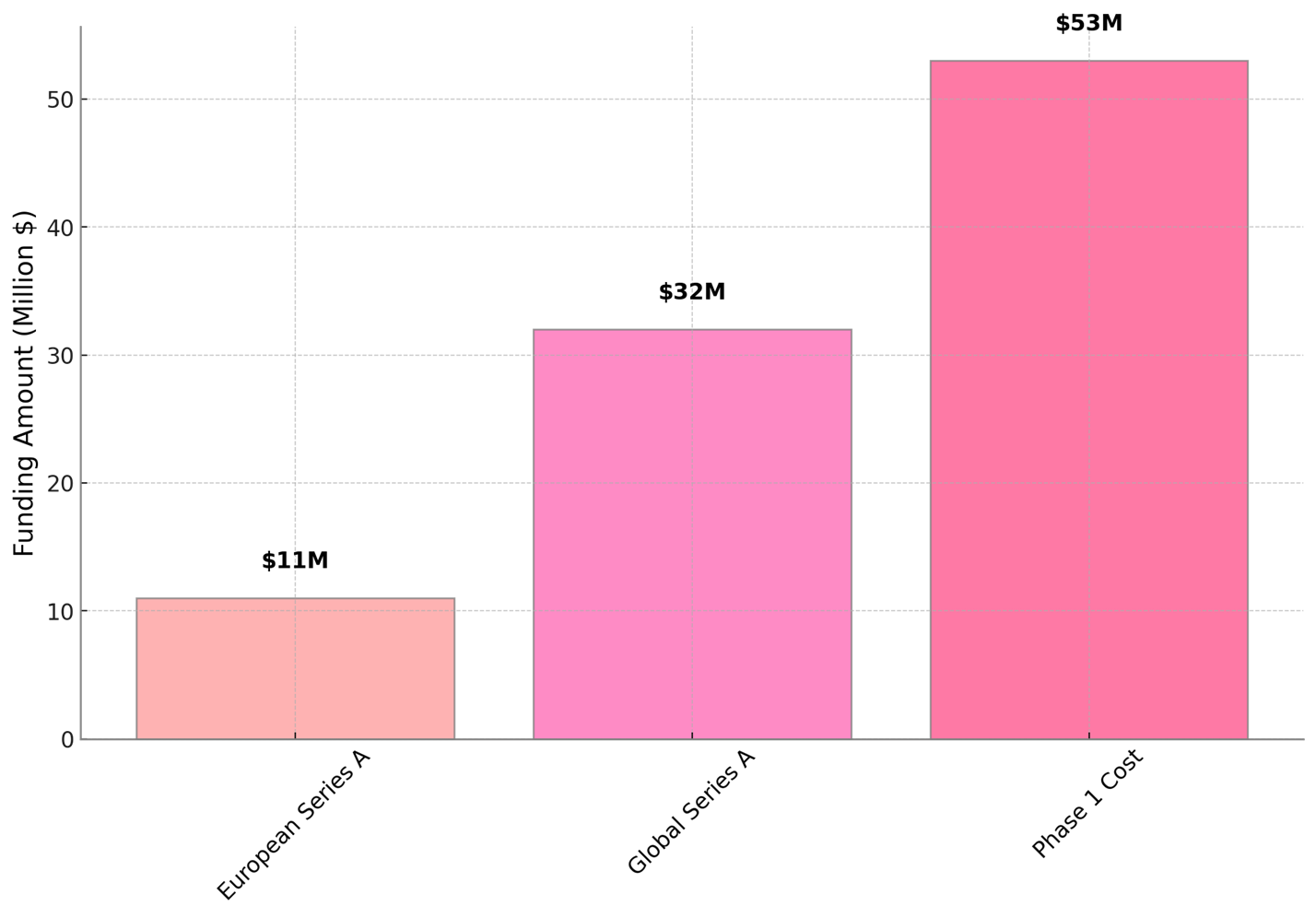

Biopharma’s Funding Gap: The Numbers Don’t Lie

Between 2020 and 2022, only 13% of global biotech IPO proceeds came to Europe, compared to 78% in the United States. That number haunted me. It wasn’t just a statistic—it was a symptom of a deeper issue.

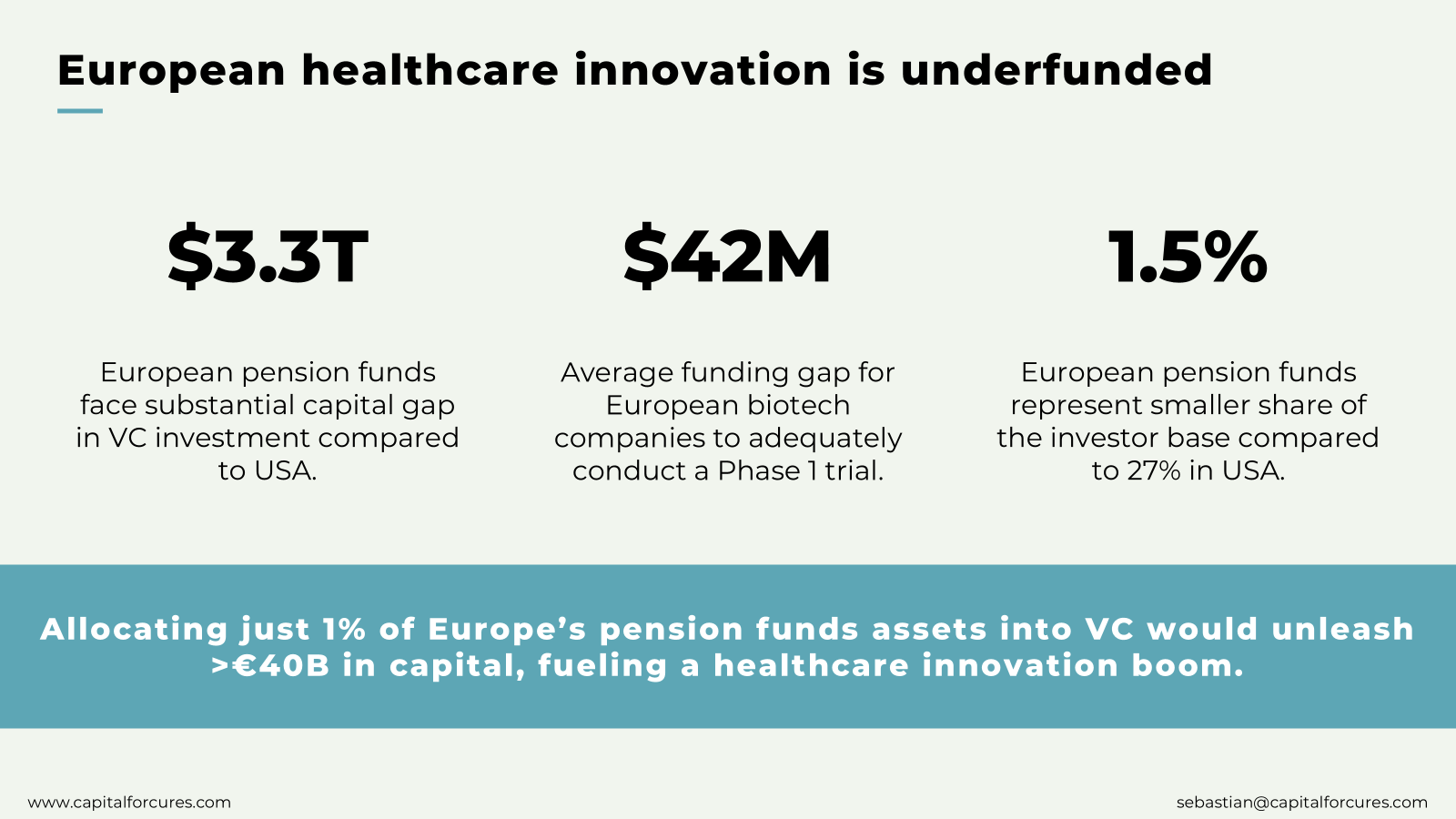

Venture capital is scarce, and what exists tends to be overly cautious. Pension funds, which drive so much VC activity in the U.S., are practically absent from the conversation in Europe. While American pension funds allocate 27% of their portfolios to VC and private equity, European funds allocate just 1.5%. That’s not a gap—it’s a canyon.

This chronic lack of growth capital leaves early-stage biopharma companies stranded. Without funding, there’s no innovation. Without innovation, there’s no pipeline. And without a pipeline, the entire ecosystem collapses.

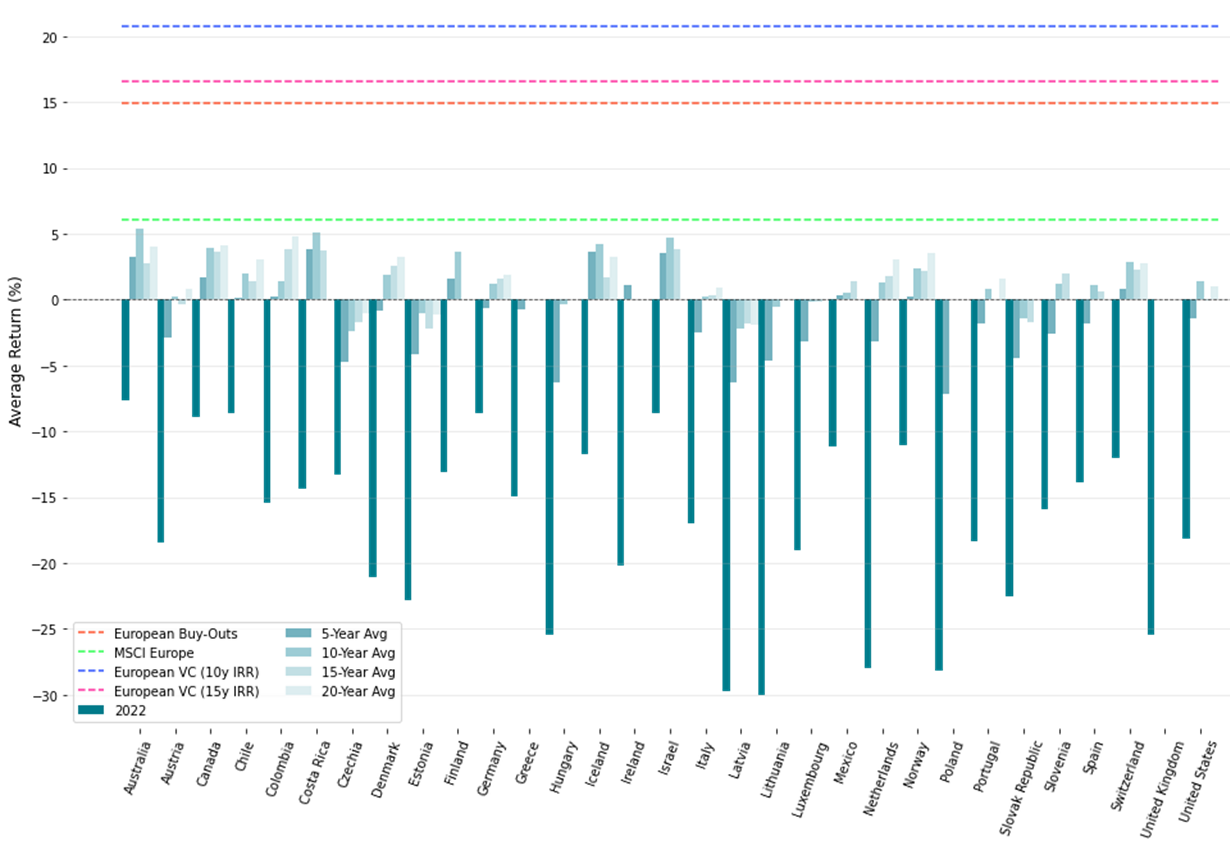

As the chart above shows, long-term pension fund returns in Europe have been stagnant—or worse, negative—over the past 20 years. While U.S. pension funds diversify into higher-yield asset classes like VC and private equity, many European funds remain overly reliant on low-yield bonds and conservative investments.

This isn’t just bad for innovation—it’s bad for the pension funds themselves. They’re failing to meet future liabilities for aging populations, all while ignoring an opportunity to boost returns by investing in industries with proven growth potential, like biopharma and healthcare.

Turning Frustration Into Action

I started Capital for Cures because I couldn’t stand to watch this cycle play out anymore. If being good at navigating the system wasn’t enough, then the system itself needed to change. I wanted to bring together the people who could actually fix the root of the problem: policymakers, investors, and industry leaders.

At its core, Capital for Cures is about unlocking the capital Europe already has and deploying it where it can make the biggest difference—healthcare innovation. Our mission is simple: to ensure that European biopharma startups get the funding they need to develop life-saving therapies, scale their businesses, and stay competitive globally.

What We’re Doing

Since launching Capital for Cures, my focus has been on creating a platform that drives real change. Here’s how:

- Publishing Insights: We’re producing data-driven analyses to highlight missed opportunities, such as the $3.3 trillion pension fund gap or the $42 million average funding shortfall for biotech trials.

- Convening Leaders: From pension funds to regulators, we’re bringing the right stakeholders to the table to build consensus and craft solutions.

- Strategic Engagement: We’re working directly with policymakers to streamline regulations, improve IPO frameworks, and create a more attractive environment for investors.

- Showcasing Global Models: By presenting successful strategies—like Korea’s IP-backed financing—we’re showing Europe what’s possible and how to get there.

This isn’t just about talking—it’s about doing. At every step, we’re focused on pragmatic, actionable solutions that benefit all stakeholders.

Why This Matters

The stakes couldn’t be higher. Without intervention, Europe’s biopharma ecosystem will continue to bleed talent, ideas, and opportunities. Patients will wait longer for treatments, and Europe will lose its ability to lead in one of the most critical industries of the 21st century.

But it’s not all doom and gloom. The solutions are within reach. If European pension funds allocate even 1% more of their assets to venture capital, we could unlock €40 billion. That’s enough to fund hundreds of startups, accelerate new therapies, and revitalize the entire sector.

Why I Believe In This

I believe in this work because I’ve seen what’s possible when the system works. I’ve seen startups with good ideas turn into thriving companies when given the chance. I’ve seen therapies that seemed impossible become realities. And I’ve seen how the right people, coming together with a shared purpose, can change the game.

Capital for Cures isn’t just about fixing Europe’s funding problem—it’s about giving the next generation of healthcare innovators the chance to succeed. It’s about ensuring that patients get the treatments they need. And it’s about proving that Europe can lead the world in innovation if it chooses to.

A Personal Invitation

If you’ve ever shared my frustration—if you’ve ever felt that Europe could be doing more to realize its potential—then I invite you to join us. Whether you’re an investor, a policymaker, a startup founder, or simply someone who believes in the power of innovation, there’s a role for you in this movement.

This isn’t just about fixing a system. It’s about shaping the future. And I, for one, am tired of waiting. Let’s get to work.

Member discussion